Hey, Hannatu here 👋

I've spent the past few months tracking African agtech like it's my personal reality show.

And one thing I can say is that 2025 was the season where everyone's masks came off. But the reveal wasn't a tragedy, it was a comeback story.

The trade deals changed, and the climate tested us, but the ecosystem didn't shrink.

It stabilized, matured, and then it did the one thing skeptics said it wouldn't: it grew.

The funding we feared would vanish actually went up a bit.

This year forced African agriculture to look in the mirror and recognize its own strength.

No more "Africa is rising" think pieces. Just the solid, data-backed reality of a sector that has stopped sliding and started climbing.

So I want to tell you about it in this final Ag Safari edition for 2025. In this edition, I’ll walk you through all the big things that happened in African agriculture in 2025, piece by piece.

But before we get into the 2025 RoundUp, we’d like to know:

How much did you enjoy Ag Safari in 2025?

In 2025, agtech funding went up!

So far, African agtech startups have raised $169.45 million in 2025 across 87 deals, per data from Africa: The Big Deal, and analysis from our partners, SAIS.

That's a slight increase from $168 million in 2024. And it’s just about 5% of the total ~$3 billion African tech startups have raised in 2025.

How much African Agtechs Have Raised Per Year Since 2020. Image Source: Ag Safari

The real story is in the broader trend.

After peaking at $366 million in 2021 and maintaining $361 million in 2022, funding dropped to $190 million in 2023.

It has since stabilized, leveling off at $168 million in 2024 before ticking back up slightly to $169.5 million in 2025.

The quarterly breakdown shows the year's rhythm.

Q1 started with 24 deals totalling $21.55 million.

Q2 nearly continued that momentum with 16 deals raising $21.90 million.

Q3 brought the most activity, with 34 deals raising $68.50 million.

And Q4 closed with 12 deals totalling $67.40 million.

Investment is still flowing.

Just more carefully. Investors are watching where their money goes and demanding clearer paths to profitability.

What’s even more interesting are…

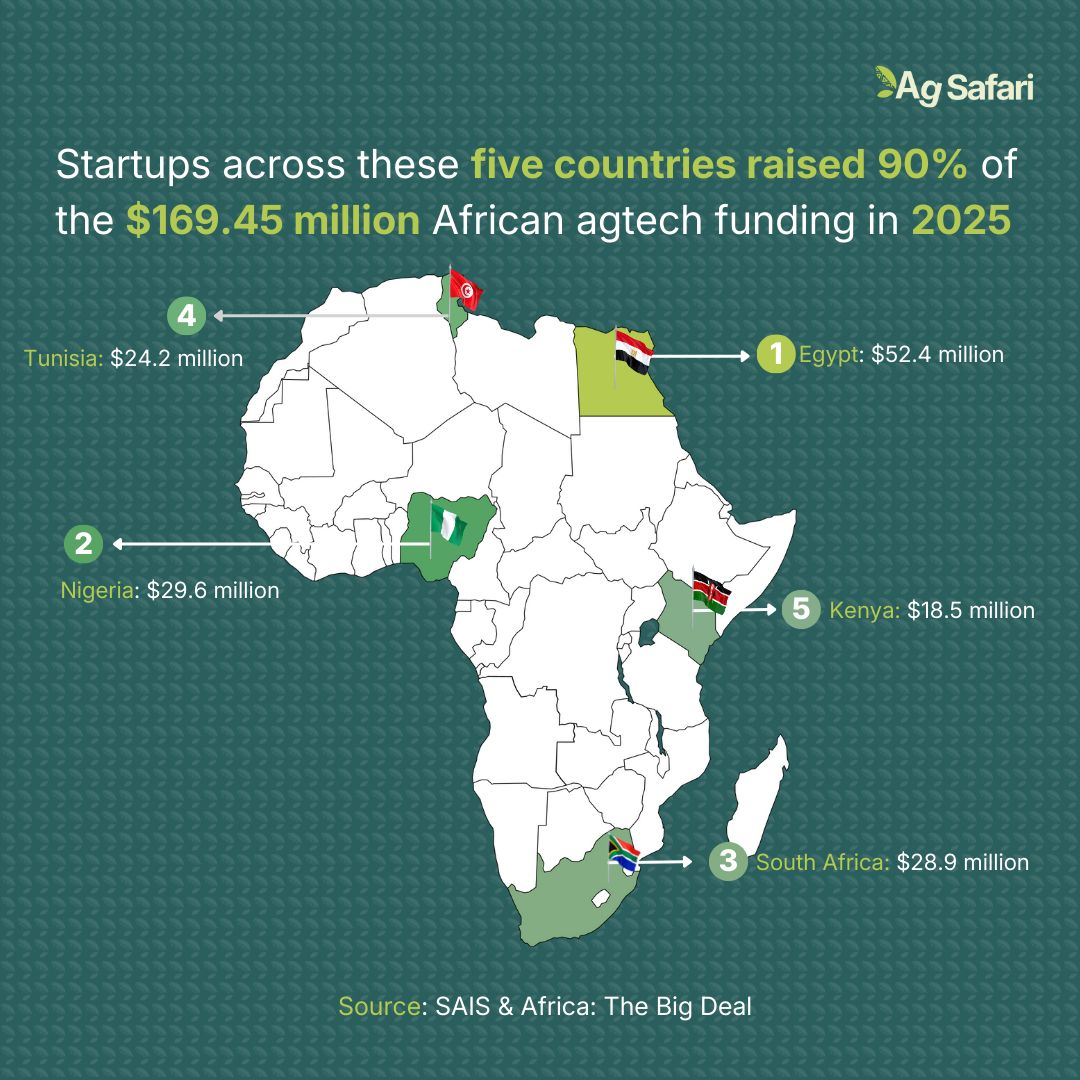

The Countries The Money Flowed Into

Egypt led the pack this year with $52.4 million raised.

This is the largest share of agtech funding on the continent.

Tagaddod's $26 million deal and Aydi's $7.5 million for AI-powered field monitoring kept North Africa ahead.

Nigeria came in second with $29.6 million.

Koolboks raised $11.2 million for off-grid refrigeration, and Chowdeck pulled in $9 million for food delivery.

African Agtech Funding in 2025 by Country. Image Source: Ag Safari.

South Africa raised $28.9 million. Nile's $11.3 million fresh produce platform and SwiftVEE's $10 million livestock auction platform led the way.

Tunisia secured fourth place at $24.2 million, which was driven almost entirely by NextProtein's $20.7 million raise for insect-based animal feed from agricultural waste.

Kenya raised $18.5 million. Pula's $10.4 million insurance grant was the standout deal. This was a drop from 2024, when the country raised

The Big Four countries raised $129.4 million total: about 76% of all agtech funding.

This is an increase from 2024, when agtechs (Twiga, SunCulture, Miro, BURN, and Pula) from the Big Four countries raised 68% of the overall funding volume.

But Deal Sizes Paint the Full Picture

5 deals crossed $10 million in 2025. These are the rounds that can actually scale operations across multiple countries.

15 deals raised between $1million - 10million. These are the startups past the hype of a launch, but also before the comfort of scale.

29 deals landed between $100K-$1million - the range where startups can expand but need to prove unit economics work.

38 deals raised less than $100,000. These are pre-seed rounds and grants helping founders test ideas before seeking larger backing.

The top six deals captured $90 million:

Tagaddod (Egypt): $26 million

NextProtein (Tunisia): $20.7 million

Nile (South Africa): $11.3 million

Koolboks (Nigeria): $11.2 million

Pula (Kenya): $10.4 million

SwiftVEE (South Africa): $10.1 million

The Top 6 African Agtech Funding Deals of 2025. Image Source: Ag Safari

Some investment themes have become staples in African agriculture, like insurance, farmer financing, and market access.

But this year, we saw new themes emerge.

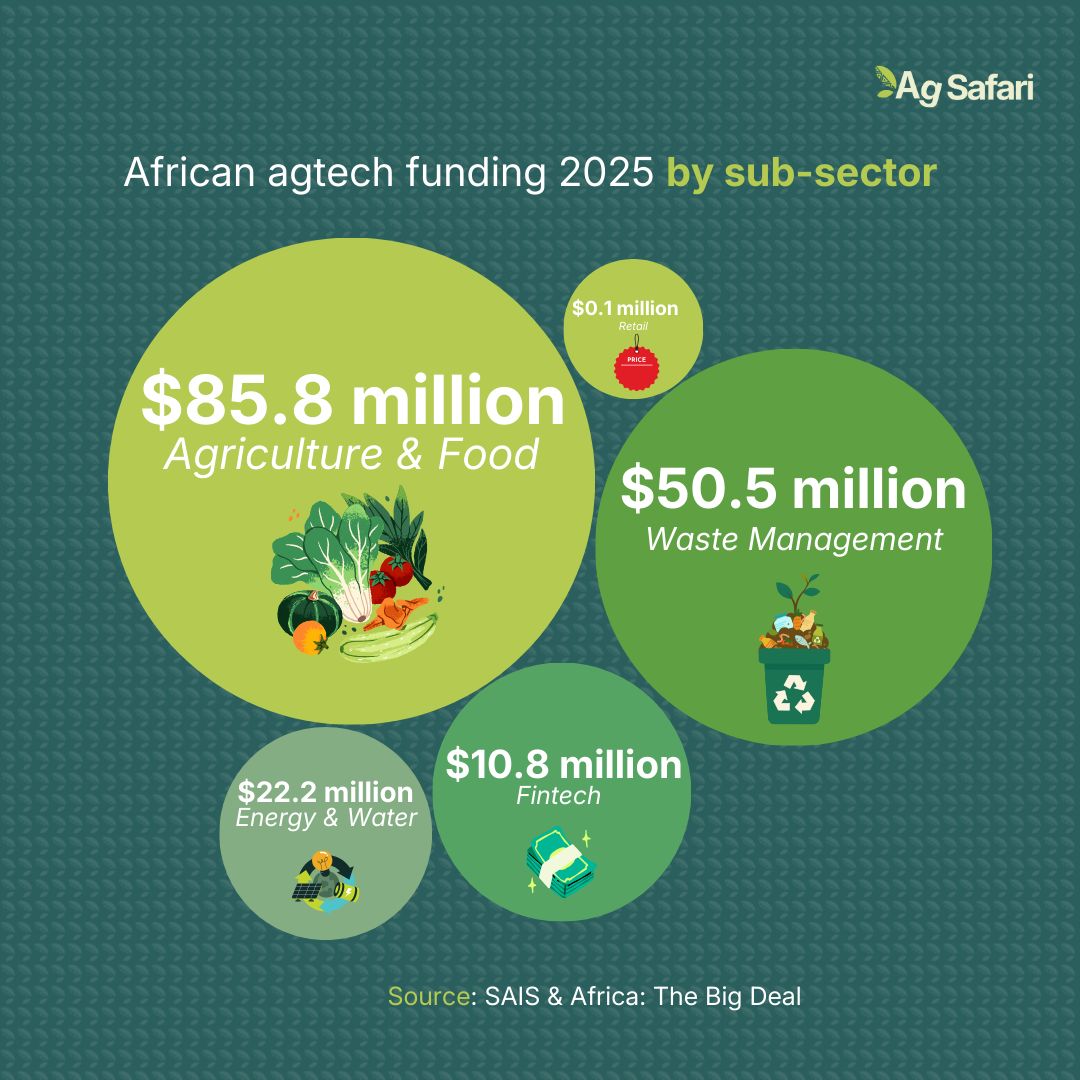

What Investors Actually Funded

For 2025, the story is driven by sector dynamics:

African Agtech Funding Per Sub-Sector in 2025. Image Source: Ag Safari

Agriculture & Food: $85.8 million (67 deals)

This category remains the volume leader, with funding spread across diverse value chains. Significant rounds included Nile ($11.3M) and SwiftVEE ($10M) in South Africa, both digitizing market access and livestock trading.

Waste Management: $50.5 million (3 deals)

Driven by the mega-rounds for Tagaddod ($26.3M) and NextProtein ($20.7M), this sector proved that circular economy models can attract serious growth capital. A smaller but notable player, Biosorra, raised $3.5M to turn ag-waste into biochar, signaling early interest in carbon removal technologies alongside waste valorization.

Energy & Water: $22.25 million (12 deals)

Investment here focused on essential infrastructure for off-grid and arid environments. Koolboks (Nigeria) led the charge with an $11M round for its solar-powered refrigeration units, crucial for reducing post-harvest loss.

Fintech: $10.8 million (4 deals)

Activity here was highly concentrated. Pula (Kenya) accounted for nearly the entire total with a $10.4M raise for its agricultural insurance platform, reinforcing the critical need for de-risking smallholder farming. The remaining deals were smaller seed investments in credit-scoring and financing platforms like Nigeria’s Crop2Cash.

Retail: $0.1 million (1 deal)

A quiet year for pure-play ag-retail, with minimal recorded activity compared to the sector's highs in previous years.

Now that we know where all the money went, it’s worth asking where it all came from.

Who's Writing Checks?

Major Agtech Investors in 2025. Image Source: Ag Safari

The Arab Energy Fund (TAEF) led Tagaddod's $26.3 million biodiesel round. North Africa remains their focus.

Cathay AfricInvest Innovation Fund backed Nile's $11.3 million raise. They're betting on fresh produce platforms.

KawiSafi Ventures and Aruwa co-invested in cold chain solutions.

HAVAÍC and Exeo Capital funded livestock auction platforms. Digitising livestock markets creates transparency.

Delta40 Venture Studio, Catalyst Fund, Antler Capital, Holocene, Marula Square, Levare Ventures, and Mercy Corps Ventures all wrote checks across multiple agtech deals.

Development finance institutions stepped in as private capital became more selective. Most deals above $2 million included concessional funding.

These aren't just VC bets, they're partnerships between impact investors and commercial funds.

Private investors shifted focus from pure software plays to asset-backed businesses. Solar panels, cold storage units, processing equipment. If the startup fails, there's something to recover.

Climate funds continued flowing, but targeted energy over agriculture.

Cleantech captured 46% of Kenya's funding. Agtech got 15%. Solar companies attracted capital that might have gone to farming technology in previous years.

New agtech-specific funds stayed quiet. No major announcements. The capital came from established players with existing commitments rather than fresh fundraising.

Now that we know what happened with funding, let’s see what happened with the startups themselves.

Here’s…

Two Things That Actually Clicked

Startups refined their models

The days of selling directly to individual farmers are fading. Agtechs are now finding ways to reach larger communities of farmers instead.

Apollo Agriculture now operates through 1,000+ agrodealers who understand local markets and speak local languages.

SunCulture shifted to group sales where farmer cooperatives buy systems together.

WARC built physical trading hubs where farmer cooperatives can meet buyers face to face.

The pattern is clear. Organized groups have better credit histories.

They negotiate better prices. They share equipment costs. The unit economics finally work.

Startups serving cooperatives and farmer groups can actually make money.

Climate technology became practical.

SunCulture's $15 million expansion brought solar irrigation to more farms. Water pumps that don't need grid electricity. Systems that pay for themselves through increased yields. Bridgin partnered with SunCulture on a $15 million expansion to bring more solar irrigation to more farms.

FAO helped South Sudan farmers install water harvesting systems. The results showed dry months dropped from six to two, and crops grew where nothing had grown before.

We also saw telecom companies like MTN deploy mobile weather alert systems that warn farmers days before storms hit in some African countries.

And New Agtechs Launched

Dairy Sense launched in Kenya to focus on empowering smallholder and large-scale dairy farmers in Africa with technology. Already, it has helped farmers across the country increase their income by 50%.

Zymera emerged in Uganda as a B2B agtech. So far, it has secured $309,000 from FasterCapital.

Fortifoods launched in Nigeria, developing nutritious, ready-to-eat food products. Antler invested $100,000.

Peelnova started in Ghana. The company works by turning orange and pineapple peels into mosquito repellents. The startup has raised $9,300 so far.

The PeelNova Team. Image Source : PeelNova

Beyond the funding and the launches, an unlikely wind blew across African agriculture in 2025.

Policy Awakened

After decades of relying on markets to solve everything, some governments acknowledged that markets don't build irrigation systems.

In January 2025, we saw The Kampala Declaration. African leaders committed to increasing food output by 45%, reducing post-harvest losses by half, and raising locally processed food to 35% of agrifood GDP by 2035.

Senegal increased its agriculture budget by nearly 38%. Most countries on the continent still allocate around 3% of their budgets to agriculture. This is far below the 10% pledged in the 2003 Maputo Declaration.

South Africa restructured its entire agricultural bureaucracy. The Department of Agriculture merged with Land Reform and Rural Development, streamlining operations.

AGOA expired after twenty-five years. African countries now face average US tariffs of 15% where they previously paid 3%. Some agricultural products face 20% or higher.

China announced zero-tariff access for all 33 African countries with diplomatic relations.

These are all good omens for Africa’s future. But for the average person on the continent…

The Food Bill Kept Climbing

Africa's food import bill reached $70 billion in 2025. Sub-Saharan Africa alone spent $65 billion, which is 4% more than 2024's $62.8 billion.

Cereals, wheat, rice, barley, wheat flour, accounted for $21.9 billion. That's 34% of total food imports. These are crops that grow well across African soil.

Most African governments allocate around 3% of their national budgets to agriculture. Nigeria allocated 1.7%, while the UN predicted 33 million Nigerians could face a severe food crisis in 2025.

The pattern persists: export raw cocoa, import Swiss chocolate. Export raw coffee, import Italian espresso. Export raw cotton, import Chinese textiles.

And while all this happened, African agriculture had a hard time fighting the elements this year because…

Here’s what 2026 Holds

All eyes are set on next year. And behind them are important questions on the future of African agriculture.

Will AGOA return? Trump's administration signalled support for a one-year extension, but Congress hasn't acted. In the meantime, countries like South Africa are exploring Asian markets.

Will agtech funding stabilise? The data suggests a bottom. After three years of decline, 2025 showed modest growth. Patient capital that understands agriculture's long cycles might return if startups demonstrate sustainable models.

How will climate impacts escalate? By 2030, 118 million extremely poor people will face drought, floods, and extreme heat. Agriculture sits in the crosshairs.

Can Africa reduce its food import bill? At $70 billion annually, there's enormous room for import substitution. But that requires investment in processing, storage, and distribution, exactly the infrastructure governments underfund.

The Reality Check

2025 forced everyone to stop pretending. No more breathless headlines about Africa's agricultural potential while importing $70 billion in food.

Despite many odds, people kept building anyway. Pula continued to insure farmers. SunCulture kept installing solar systems. New startups launched in Lagos, Kampala, and Accra with smaller rounds but clearer business models.

The wins are incremental. The challenges are massive. The gap between what's needed and what's being done is still wide.

But 2025 gave us something valuable: clarity. We know what doesn't work. We're learning what might.

2026 will show if the lessons stick.

What impressed you most about African agriculture in 2025?

Was it a startup solving a real problem? A policy shift in your country? A farmer or community doing something innovative?

See you in 2026,